The Graphite Electrode Industry at a Crossroads: Soaring Demand and Environmental Imperatives Reshape the Market Landscape

2025-03-20

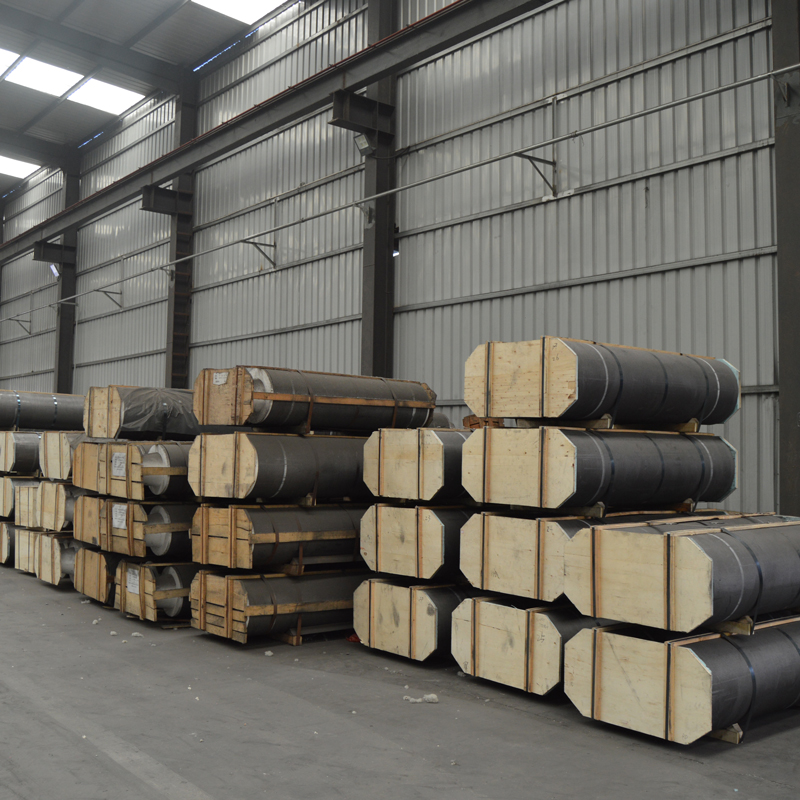

In 2025, the global graphite electrode industry stands at a pivotal juncture amid rapid transformation. Accelerated adoption and expansion of Electric Arc Furnace (EAF) steelmaking, coupled with the commissioning of new capacities in emerging markets, have triggered a surge in graphite electrode demand. Concurrently, raw material supply constraints and increasingly stringent environmental regulations are driving technological advancements and structural adjustments within the sector. This article delves into the latest industry developments, analyzing market supply-demand dynamics, innovation trends, and green manufacturing trajectories, while offering insights into the industry's future outlook.

Sustained Demand Growth Driven by Expanding EAF Capacities

Emerging economies such as India, Vietnam, and Indonesia continue to invest heavily in new EAF steelmaking projects, resulting in a substantial increase in graphite electrode consumption. Industry data indicates that global demand for Ultra High Power (UHP) graphite electrodes rose by over 25% year-over-year in the first half of 2025, with particularly strong growth in larger diameter electrodes of 600mm and above.

The energy efficiency and reduced carbon footprint of EAF steelmaking underpin its growing prominence in the global steel industry’s decarbonization efforts. As steelmakers pursue enhanced operational efficiency and product quality, there is a rising preference for graphite electrodes exhibiting low electrical resistivity, high oxidation resistance, and extended service life—factors driving innovation in electrode material formulations.

Needle Coke Supply Constraints Spur Strategic Diversification

Needle coke, the primary raw material for graphite electrode production, which largely determines electrode quality and cost, faces significant supply-side challenges. Environmental policies and production restrictions in China have curtailed the output of high-quality needle coke, intensifying supply shortages. Global price volatility of needle coke further exacerbates cost pressures for electrode manufacturers.

To mitigate these risks, leading enterprises have expanded procurement from international suppliers and accelerated R&D to improve domestic needle coke quality. Supply chain diversification and strategic sourcing are increasingly prioritized to ensure feedstock stability and production continuity.

Environmental Regulations Accelerate Green Process Innovation

Tightening environmental regulations have compelled graphite electrode manufacturers to adopt greener production technologies. The widespread implementation of closed, energy-efficient graphitization furnaces and calcining systems has significantly reduced carbon emissions and energy consumption during electrode manufacture. Companies are actively pursuing green certification programs to enhance their sustainability credentials and competitive positioning in export markets.

Additionally, several manufacturers are investing in carbon neutrality initiatives, targeting emission reductions across the entire electrode lifecycle. Environmental compliance now constitutes a core component of corporate social responsibility and market differentiation strategies.

Digital Marketing and SEO Empower Global Market Expansion

In response to digital transformation trends in global procurement, Chinese graphite electrode companies are intensifying their online marketing efforts. Strategic SEO targeting keywords such as “UHP graphite electrode” and “graphite electrode price,” complemented by Google Ads campaigns, has improved visibility and lead generation in key overseas markets.

The deployment of multilingual websites, virtual trade exhibitions, and active social media engagement has bolstered brand recognition and customer trust. Industry experts advise that leveraging big data analytics and content marketing can further refine customer targeting and accelerate international business development.

Customization Drives Market Segmentation and Competitive Advantage

Increasingly diverse steelmaking equipment and process requirements have fueled demand for customized graphite electrodes. Manufacturers are providing non-standard electrode dimensions, reinforced nipple designs to enhance joint integrity, and electrodes formulated for superior oxidation resistance in high-temperature environments such as the Middle East. Such tailored solutions help steelmakers optimize furnace performance and reduce operating costs.

Customization enhances product value and client retention, representing a critical pathway for companies aiming to differentiate their offerings and fortify their competitive edge in a mature market.

Outlook

The graphite electrode industry is undergoing profound change, propelled by unprecedented demand growth and environmental imperatives. Technological innovation and supply chain optimization are vital to sustaining this momentum. Moving forward, companies that capitalize on green manufacturing practices, embrace digital transformation, and deliver differentiated, customer-centric solutions will solidify their leadership positions.

As the global steel industry accelerates its transition to low-carbon production, the graphite electrode sector is poised to maintain robust growth and innovation, playing an essential role in supporting sustainable steelmaking worldwide.

Please leave us a message

- English

- French

- German

- Portuguese

- Spanish

- Russian

- Japanese

- Korean

- Arabic

- Irish

- Greek

- Turkish

- Italian

- Danish

- Romanian

- Indonesian

- Czech

- Afrikaans

- Swedish

- Polish

- Basque

- Catalan

- Esperanto

- Hindi

- Lao

- Albanian

- Amharic

- Armenian

- Azerbaijani

- Belarusian

- Bengali

- Bosnian

- Bulgarian

- Cebuano

- Chichewa

- Corsican

- Croatian

- Dutch

- Estonian

- Filipino

- Finnish

- Frisian

- Galician

- Georgian

- Gujarati

- Haitian

- Hausa

- Hawaiian

- Hebrew

- Hmong

- Hungarian

- Icelandic